There is some evidence that property prices are recovering. Property prices increased nationally by 0.5% in April and 0.6% in March, according to CoreLogic. Property prices have increased even more in some areas. For example, in Sydney property values increased by 1.3% in April and are now 3.0% higher than in January.

Further evidence of a recovery are:

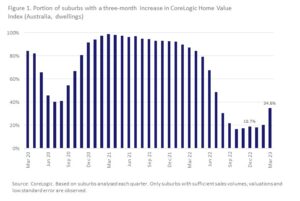

- During the March quarter, property values rose in 35% of the suburbs analysed by CoreLogic compared to 19% in the December quarter (see graph below)

- The capital city auction clearance rate was above the decade average for six out of the past eight weeks to 20 April

- Vendor discounting was at 4.2% in the March 2023 quarter, compared to 4.4% in the December quarter

Why would property prices be rising?

Property prices, like the economy, are driven by supply and demand. Prices can increase when demand is high, or when supply is low. CoreLogic’s research director, Tim Lawless, highlights two key aspects that could be driving up demand and thereby property prices:

- A shortage of rental properties might be forcing more people, especially immigrants, to buy instead of rent.

- With the market downturn, fewer vendors put their properties on the market and this has increased demand for the properties that are on the market.

Effect of mortgage rates on property prices

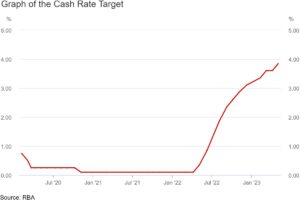

One of the goals of the Reserve Bank of Australia’s (RBA) monetary policy is to keep inflation in check. Australia’s inflation rate for the year to March was 6.3%, but it reached 7.8% in December, according to the Australian Bureau of Statistics. This is much higher than the 2-3% the RBA finds acceptable. To try and reduce inflation, it has kept increasing the cash rate from 0.10% in April 2022 to 3.85% in May 2023.

The RBA counts on lenders increasing their mortgage rates in tandem with cash rate increases because if home owners pay more for debt, they have less money to spend. With less demand for goods, prices should drop.

In theory, this should similarly affect property prices. Because if it costs more to pay back a mortgage, there should be fewer buyers. With less demand, prices should decrease. In practice, there are other factors at play, like the shortage of rental properties and the benefits of owning a property for financial security and long-term capital growth.

And an increase in mortgage rates might not trickle through immediately. For example, some homeowners won’t need to reduce their spending because they have fixed-rate mortgages or sufficient savings.

How do interest rates affect property values?

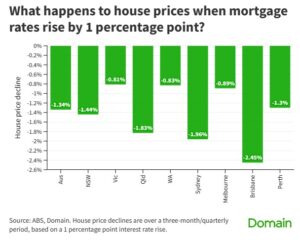

Domain compared house prices and mortgage rates in Australia over a 30-year period. It found that on average a 1 percentage point increase in mortgage rates caused a 1.34% drop in house prices. Prices dropped even more in New South Wales, Queensland and the capital cities (see graph below).

And house prices dropped in the same quarter as an increase in mortgage rates.

Population growth

Domain’s study highlighted a more interesting finding. Population growth had a cumulative long-term effect on house prices, and this effect was much stronger than changes in interest rates (see graph below).

Consequently, house prices increased long-term when the population size increased, regardless of mortgage rates.

Popular suburbs

Another anomaly is found in sought-after suburbs. When demand for properties remained high and supply remained low, property prices in those suburbs did not decrease, despite the general downturn or mortgage rate changes.

“While the market has shifted more generally in favour of buyers, I think that in tightly held or highly sought-after areas, they don’t ever truly fall into that bucket of a ‘buyers’ market’,” said Domain chief of research and economics Dr Nicola Powell.

Therefore it is possible for property prices to be recovering, despite the most recent increase in the cash rate.