Australia’s property market is ever-evolving, influenced by a multitude of factors from interest rates to supply dynamics. To stay ahead of the game, it’s essential to be aware of the trends shaping the market. Here are the top five you need to know about this spring.

More choice for buyers

Spring often brings a rise in new property listings, but this wasn’t the case last year. Fortunately, things have turned around this year with SQM Research reporting a large jump in new listings for September. Nationally, it was the strongest month for new listings since April 2022, with a 14.3% increase in the number of properties hitting the market. As the table below shows, the surge in listing activity drove a 9.3% monthly rise in total properties advertised, giving buyers more options.

Interest rates at or close to their peak

The Reserve Bank of Australia (RBA) kept the country’s official interest rate unchanged at 4.10% in September, the fourth straight month there’s been a pause. While new RBA governor Michelle Bullock warned more rate hikes could still be on the table to return “inflation to target within a reasonable timeframe”, many market commentators believe that interest rates have peaked.

This stability is providing more certainty for both buyers and sellers, fostering increased market activity.

Ultra-tight rental market conditions to continue

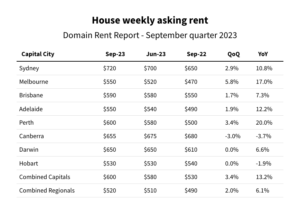

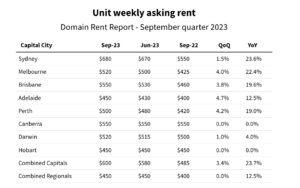

Domain’s latest rental report showed the national rental vacancy rate plummeted to 0.8% over the September quarter, the lowest level since March. With rental properties scarce, cities like Sydney, Melbourne, Brisbane, Adelaide, and Perth are witnessing record-high rents (see charts below).

According to Domain chief of research Dr Nicola Powell, Australia needs to add about 70,000 rental properties to bring the vacancy rate to a more balanced 2-3%. But with recent Australian Bureau of Statistics data showing building approvals down by 22.9% year-on-year in August, there’s little relief in sight for tenants.

Multi-speed markets

Though CoreLogic’s national home value index has now risen for eight months straight after gaining 0.8% in September, the picture varies considerably across different capital cities. Adelaide led the capital gains with a 4.3% quarter-on-quarter increase over the three months to September, followed by Brisbane (3.9%) and Perth (3.6%). Hobart, however, saw a decline of 0.2%, reaching a new cyclical low.

CoreLogic’s research director Tim Lawless said supply levels are playing a critical role in these regional differences, with cities experiencing growth generally having lower supply levels compared to their historical averages.

Property price growth likely to continue

KPMG is the latest big institution to predict Australian property prices will soar over the next year and beyond, joining Westpac, NAB, and Domain. The accountancy firm predicts limited supply combined with record-high immigration and the tight rental market to see house prices grow by 4.9% over the next nine months and then spike by 9.4% in the year to June 2025.

Apartment prices are expected to rise by an average of 3.1% by next June, with a subsequent 6% rise over the following 12 months. Regional variations are expected, with Perth houses predicted to rise the most at 8.4% by the end of the fiscal year, while Hobart is set to lead in FY25 with a 14.2% increase.

Catalyst is a multi-award-winning advisory business. If you are looking to buy an investment property, fill in this form, phone 1300 411 455 or email info@catalyst.com.au