As property prices in Sydney reach record highs, investors might be wondering if the Sydney property market is a good place to put your money. But while there are challenges, signs are pointing towards sustained capital growth for investors in Sydney. Here’s why:

Market cycles

Investment is a long game. So while analysing short-term trends can help you determine current affordability, you should pay more attention to the property market’s longer cycles. CoreLogic research director Tim Lawless examined the last three decades of Australia’s property market and found six clear cycles of growth and decline. “While housing values move through cycles of growth as well as declines, the long-term trend is undeniably upwards,” he said.

Over the last 30 years, dwelling prices have increased 449.0%, working out to an average annual average of 5.8%. Sydney performed even better, with house prices up a staggering 507.0%, while unit prices grew 340.1%.

Population increases

The people element of the property market is just as important as the homes themselves. So, for investors, it’s important to look at demographic trends to get an idea of what future demand there will be for properties. After an influx of migrant numbers returning post-pandemic, population figures in Sydney have continued to grow. Projections show that the population in New South Wales is expected to grow by 85,000 people each year until 2041. This is an increase of around 1.0% each year.

For the Greater Sydney area, the state government has predicted the city will reach 6.1 million people by 2041, up from the current population of 5.2 million, recorded during the 2021 census. This population growth will create continued demand in the housing sector, boding well for investors.

Sydney’s rental market

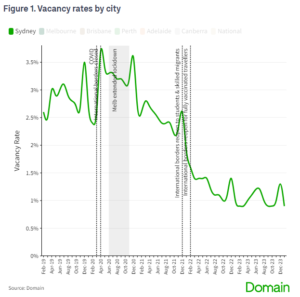

Moreover, the rental market in Sydney looks promising for investors, as it’s currently characterised by low vacancy rates and rising yields. The rental vacancy rate in the city returned to its record-low of 0.9% in January 2024, according to Domain. As the graph below shows, rental vacancy rates in the city have remained under 1.5% since early 2022.

With the city’s population on the rise, demand for rental properties is expected to remain robust, ensuring a stable income for landlords that can help offset investment costs.

Asking rents have increased in Sydney, up 10.2% in 2023 according to CoreLogic. In December 2023, asking weekly median rent for Sydney was $745. The gap between asking rents for houses and units has closed somewhat, now at $38 a week, down from $63 at the beginning of 2022. For investors, this could indicate an increase in rental yield from units.

Gross rental yields in the city are positive for investors too, as CoreLogic reported they ended the year on a 3.0% increase.

“Considering we are yet to see any material response in rental supply, growth in rents is likely to remain above average in 2024,” said Lawless.

Finance for investors

Investing in Sydney at the moment can look expensive at face value, but a deeper look into the long-term potential of the Sydney investment market paints a more promising picture. The tight rental market coupled with the added demand that a bigger population will bring spells positive news for investors.