As mortgage rates increase, many affected homeowners are considering refinancing their home loans to mitigate the impact. But some homeowners are unable to refinance their home loans and find themselves trapped in uncompetitive deals. How did they get there?

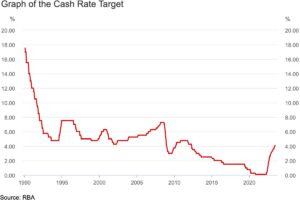

Well, the Reserve Bank of Australia has steadily been increasing the cash rate since May 2022 as it acts to curb inflation (see graph below).

The RBA finds an inflation rate between 2-3% acceptable. So if the inflation rate is higher, the central bank considers increasing the cash rate to curb spending.

Mortgage Cliff

During the Covid-19 pandemic, the economy came to a virtual standstill as many industries experienced lockdowns. To boost economic activity the RBA reduced the cash rate to 0.10%. With the cash rate at an ultra-low 0.10%, many lenders offered low mortgage rates.

To take advantage of these low rates, some homeowners fixed their mortgage rates at the time. Now as their fixed-rate terms start expiring, they’re facing a mortgage cliff ─ a massive increase in rates – as they move onto their lender’s standard variable rate.

The lender’s standard variable rate is likely to be at least 4 percentage points higher than their old fixed rate, if not more. Fortunately, Australia’s home loan marketplace is very competitive so some borrowers may be able to secure a lower rate and save money by refinancing their home loans.

But some homeowners can’t refinance their home loan ─ and in some cases, it’s because of the serviceability buffer.

Serviceability Buffer

The serviceability buffer is set by APRA, the banking regulator, as a cautionary measure to ensure homeowners can afford their mortgage instalments should mortgage rates increase.

Currently, the serviceability buffer is three percentage points. This means, for example, if you were to apply for a home loan with a variable rate of 6.31%, you would actually be assessed on your ability to pay an interest rate of at least 9.31%.

However, back when many Australians fixed their home loans, APRA’s mortgage serviceability buffer was lower at 2.5 percentage points. This means that many homeowners who qualified for loans then weren’t tested under current, tighter conditions.

Consequently, some mortgage holders no longer qualify for their existing home loans (although banks won’t withdraw the existing loans). Additionally, those borrowers can’t refinance.

How Are Lenders Handling The Situation?

In February, APRA confirmed it was not changing the serviceability buffer because it was appropriate for the heightened risks in the financial system. But the banking regulator said it would continue to monitor the key risk indicators, including credit growth, asset prices, lending conditions and financial resilience.

Not all lenders agree with APRA’s position. Some feel the serviceability buffer is too high and trapping too many mortgage holders.

Accordingly, some non-bank lenders that are not regulated by APRA have started reducing their own internal serviceability buffers.

One of the major banks also introduced a modified serviceability assessment rate that certain clients could qualify for. Some of the conditions include having a good track record, standard home loans with interest and capital repayments, at least 80% loan-to-value ratios and a credit score exceeding 650.

With these changes, homeowners trapped in uncompetitive deals may now be able to escape.