Australia’s population is growing at historically high levels, even as the number of vacant rental properties declines. A year ago, there was much talk in the media about property investors being in firm control of the rental market due to the very low vacancy rate (which measures the share of unfilled rental properties). Twelve months later, nothing has changed.

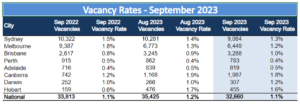

Between September 2022 and September 2023, the national vacancy rate held steady at an ultra-low 1.1%, according to SQM Research, while the number of vacancies actually fell, from 33,813 to 32,660. Focusing just on Sydney, the vacancy rate declined over the year, from 1.5% to 1.3%, while the number of vacancies fell from 10,322 to 9,084.

Demand increasing, supply decreasing

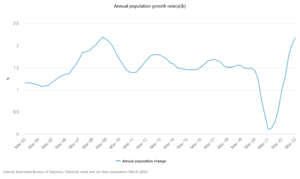

As with any market, the tight rental market is the result of supply and demand factors. On the demand side of the equation, the population grew by 2.2% over the year to March, according to the most recent data from the Australian Bureau of Statistics (ABS), which was the strongest growth rate in 15 years.

In numerical terms, that meant our population increased by 563,000 people – more than the population of Canberra.

And that brings us to supply.

Housing an extra 563,000 people requires another 223,413 new homes, because the average household contains 2.52 people, according to the most recent Census. However, we built only 174,921 homes during that period, according to the ABS.

Furthermore, as the graph shows, housing construction activity has been declining.

With housing demand trending up and housing supply trending down, it’s no wonder vacancy rates are so low.

There’s one other point worth mentioning. From a rental market point of view, what matters is not so much the total amount of housing in Australia but the total amount of rental housing.

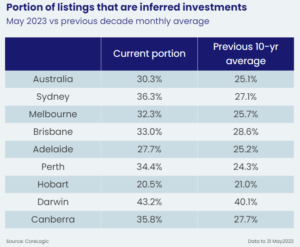

As it turns out, property investors are selling their homes at above-average rates, according to CoreLogic. Over the past 10 years, an average of 25.1% of properties being sold at any one time across Australia have been investment properties; but in May, it was 30.3%.

When investors sell, the pool of rental housing declines (because while some properties get bought by other investors, most are purchased by owner-occupiers). So this is another factor that is affecting rental supply and therefore the overall market.

Why the future looks bright for investors

Here’s a good rule of thumb to understand vacancy rates:

- When the vacancy rate is above 3%, it’s a tenant’s market

- When the vacancy rate is 2-3%, it’s a balanced market

- When the vacancy rate is below 2%, it’s a landlord’s market

Right now, capital city vacancy rates range from 0.4% (Perth) to 1.8% (Canberra), so every capital is a landlord’s market.

That means it’s easy for landlords to find tenants (because so many are applying for each listing) and hard for renters to find accommodation (because there’s so much competition). Some tenants are willing to pay higher prices to beat the competition, which is putting upward pressure on rents. Over the year to September, national rents increased by 8.4%, according to CoreLogic.

Vacancy rates are likely to stay low for the foreseeable future, because population growth is showing no signs of decreasing and residential construction no signs of increasing. That, in turn, means rents are likely to keep rising.