Last year ended with the cash rate at a 12-year high of 4.35%. So what can we expect from the cash rate – and, by extension, mortgage rates – in 2024?

The big four banks have slightly different expectations of how the Reserve Bank of Australia (RBA) will manage monetary policy, but agree on the broad direction:

● Commonwealth Bank believes the cash rate has peaked and will fall to 3.60% by the end of this year

● Westpac believes the cash rate has peaked and will start falling from September

● ANZ believes the cash rate has peaked and will start falling from December

● NAB believes the RBA will increase the cash rate to 4.60% early in the year, before starting to cut rates in November

The RBA is determined to crush inflation

The RBA board has made it clear that inflation will be front and centre of its monetary policy. Inflation peaked at 8.4% in December 2022 and had fallen to 4.3% by November 2023, according to the latest data from the Australian Bureau of Statistics, but that’s still much higher than the RBA’s target range of 2-3%.

The reason the RBA board started raising the cash rate in May 2022 was to slow the economy, and thereby put downward pressure on inflation. The previous governor, Philip Lowe, and the current incumbent, Michele Bullock, have said repeatedly the RBA was determined to crush inflation. Just last month, Governor Bullock stressed, yes again, that the board “remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome”.

The lower inflation gets and the faster it falls, the less likely the board will be to make further cash rate increases – and the more likely it will be to start thinking about starting a rate-cutting cycle.

The inflationary outlook remains uncertain

Reading the minutes of the RBA’s most recent monetary policy meeting, in December, reveals that the inflationary outlook is uncertain, because different economic forces are pushing in different directions. On the one hand, inflation has been falling, the economy has been slowing and unemployment has been rising.

On the other hand, inflation has been falling more slowly than expected, the economy has been stronger than expected and unemployment remains very low. Also, home loans activity and property prices have been rising.

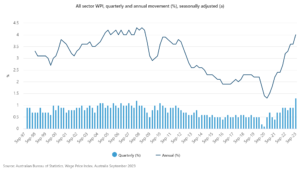

Wages growth appears to be neutral – while wages have been rising (see graph below), the board believes wages growth is not expected to increase much further and remains consistent with the inflation target, provided productivity increases.

“There are still significant uncertainties around the outlook,” the RBA board concluded.

“While there have been encouraging signs on goods inflation abroad, services price inflation has remained persistent and the same could occur in Australia. There also remains a high level of uncertainty around the outlook for the Chinese economy and the implications of the conflicts abroad.

“Domestically, there are uncertainties regarding the lags in the effect of monetary policy and how firms’ pricing decisions and wages will respond to the slower growth in the economy at a time when the labour market remains tight.

“The outlook for household consumption also remains uncertain, with many households experiencing a painful squeeze on their finances, while some are benefiting from rising housing prices, substantial savings buffers and higher interest income.”

Why 2024 rate cuts are on the agenda

The RBA board said it would make future cash rate decisions based on “developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market.”

What seems clear, though, is that if we’re not at the very top of the interest rate cycle (as three of the big four banks believe), we’re very close.

It’s highly likely the economy will continue to slow in 2024, which would put downward pressure on inflation. So while the concern since 2022 has been that the economy has been running too hot and therefore delivering high inflation, the concern from the second half of this year might be that the economy has started running too slowly. If that happens, cash rate cuts will be very much on the RBA’s agenda.