After property markets around the country declined during 2022, there was a general resurgence over 2023, leading many to wonder what’s in store for next year. To get a sense of how things might play out in 2024, we first need to recognise how the current market is placed.

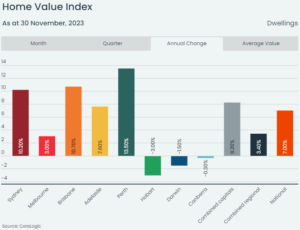

Over the year to November, the national median property price rose 7.0%, according to CoreLogic. That said, only five of the eight capital cities recorded price growth – Sydney, Melbourne, Brisbane, Perth and Adelaide. The other three capital cities – Hobart, Canberra and Darwin – went backwards, showing that this growth cycle has not been universal.

Broadly speaking, those five growth markets have experienced strong buyer demand and relatively low levels of supply (i.e. property listings) during 2023, while the other three have had lower demand and higher supply.

But as the effect of higher interest rates begin to bite and the economy slows, those dynamics might change in 2024. That’s the bearish view.

On the flip side, strong population growth, a more relaxed lending environment and limited housing supply might lead to further price growth next year. That’s the bullish view.

Let’s look at both cases in more detail.

Why prices might fall in 2024

SQM Research managing director Louis Christopher believes that property prices will increase in Perth, Brisbane and Adelaide during 2024 but decline in the other capital cities. As a result, the combined capitals will end the year between 1% lower and 3% higher.

Mr Christopher believes demand will be affected by elevated interest rates, reduced housing affordability, a slowing economy and slowing population growth (due to lower immigration).

“If I am wrong and the housing market has another strong year, it will be because employment growth has continued to be firm and/or migration has once again grown more quickly than expected and homeowners once again have managed to withstand the higher lending rate environment,” he said.

Why prices might rise in 2024

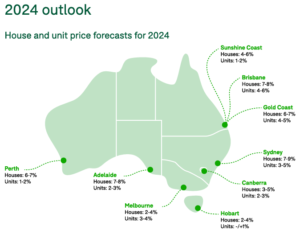

But Domain’s chief of research & economics, Nicola Powell, is more optimistic. She expects national house prices to rise 5-7% and national unit prices to rise 2-4%, and that house and unit prices will increase in every capital city during 2024.

Like Mr Christopher, she believes affordability concerns and a slowing economy will put downward pressure on price growth. However, she believes these will be outweighed by three other factors.

First, strong population growth will buttress demand. “Unprecedented post-COVID migration and population growth will continue to send shock waves through the property market as a booming population looks for a place to live. It will continue to exert extraordinary upward price pressures on the property market,” Dr Powell said.

Second, the mortgage serviceability buffer (currently 3 percentage points) may be reduced, which would make it easier to qualify for home loans. “If this buffer is reduced, it will speed up access to the property market for many by lifting borrowing capacity, increasing demand and resulting in swift upward price pressures on the housing market. This, together with the prospect of a cash rate cut in the latter half of 2024, would most likely signal a further gear change in property price,” she said.

Third, Dr Powell said the supply of housing would not be able to keep up with all this demand. “Given Australia’s slowing housing supply in the face of a bigger Australia, the extremes of a supply shortfall will exert upward pressures on the housing market,” she said.